Understanding portfolio diversification is essential for investors seeking to mitigate risk and maximize returns. Diversifying your investments across various asset classes can help shield your portfolio from market volatility and unforeseen events. Let’s explore the fundamentals of portfolio diversification and how it can contribute to your financial success.

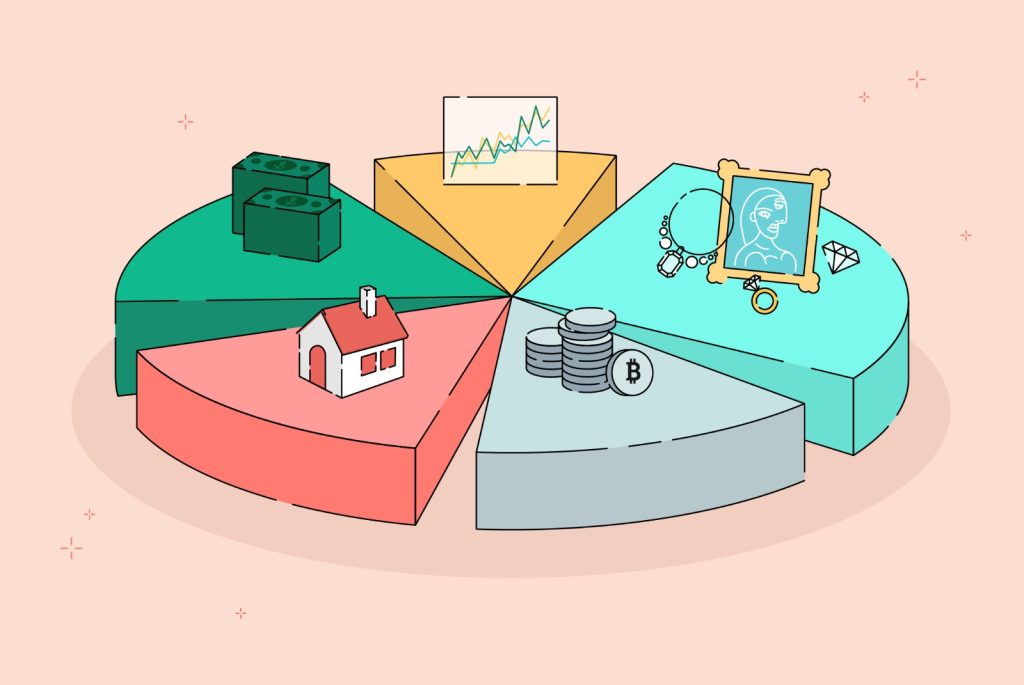

Diversification involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. By allocating your assets strategically, you can reduce the impact of market fluctuations on your overall portfolio performance. This approach aims to achieve a balance between risk and reward, ensuring that your investments are not overly concentrated in any single asset or sector.

Benefits of Portfolio Diversification

Portfolio diversification is crucial for investment strategy, providing multiple benefits. It spreads investments across different assets, sectors, and regions, reducing overall portfolio risk. If one investment performs poorly, others may offset losses. Diversification also decreases portfolio volatility, resulting in more stable returns, especially in uncertain markets.

Moreover, diversifying can optimize risk-adjusted returns by balancing risk and reward. While some investments offer high returns, they often carry high risk. By diversifying across assets with varying risk levels, investors can aim for a balance that maximizes returns while minimizing overall risk. This strategy instills confidence in pursuing financial goals, knowing the portfolio can endure market conditions.

Ultimately, portfolio diversification is essential for long-term wealth building and financial success.

Strategies for Diversifying Your Portfolio

Portfolio diversification spreads investments across asset classes like stocks, bonds, and real estate to balance risk and return. It reduces the impact of one investment’s poor performance on the entire portfolio, mitigating risk during market downturns.

Diversification within asset classes, like investing in different industries, enhances risk management by avoiding overexposure to specific risks. It also allows for capitalizing on growth potential across sectors while spreading risk.

Geographic diversification is crucial too, as investing globally reduces the impact of localized events or geopolitical risks. It spreads risk and captures opportunities in various markets, creating a more resilient portfolio.

Importance of Rebalancing Your Portfolio

Rebalancing plays a crucial role in portfolio diversification, ensuring that the allocation of assets remains aligned with the investor’s risk tolerance and financial goals over time.

Strategies for Rebalancing:

- Target Asset Allocations: Investors establish target percentages for each asset class based on their risk tolerance and investment objectives. Regular monitoring helps ensure that the portfolio maintains these target allocations.

- Rebalancing Bands: Setting upper and lower thresholds for asset allocations allows investors to trigger rebalancing when the allocations deviate beyond these bands. This approach helps prevent overexposure to high-performing assets and maintains diversification.

- Calendar-Based Approach: Investors rebalance their portfolios at predetermined intervals, such as quarterly or annually, regardless of market conditions. This systematic approach simplifies the process and reduces the influence of short-term market fluctuations on decision-making.

Monitoring and Adjusting Your Portfolio

Monitoring and adjusting your portfolio are fundamental tasks in the realm of successful investing. By regularly evaluating your portfolio’s performance, you stay abreast of market trends and economic indicators, enabling well-informed decision-making. This proactive approach allows you to make necessary adjustments, such as reallocating assets or adding new investments, to ensure that your portfolio remains in line with your long-term financial objectives and maintains an optimal level of diversification.

Furthermore, periodic reviews of your portfolio serve as a critical tool for risk management and strategic planning. By assessing the performance of individual investments and their contribution to the overall portfolio, you can identify areas of strength and weakness. This insight empowers you to make strategic adjustments, mitigating potential risks and capitalizing on emerging opportunities, ultimately enhancing the resilience and effectiveness of your investment strategy over time.

Achieving Financial Stability through Portfolio Diversification

Portfolio diversification is a cornerstone of sound investment management, offering investors a prudent approach to managing risk and maximizing returns. By diversifying across asset classes, employing strategic allocation strategies, and regularly monitoring and rebalancing your portfolio, you can build a resilient investment portfolio that withstands market volatility and helps you achieve your financial goals over time.

7 Top Gene-Editing Stocks to Buy <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore potential CRISPR stocks to enhance your investment portfolio with promising opportunities. </p>

7 Top Gene-Editing Stocks to Buy <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore potential CRISPR stocks to enhance your investment portfolio with promising opportunities. </p>  7 Oversold Tech Stocks to Buy <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore undervalued tech stocks with potential for growth in the market. </p>

7 Oversold Tech Stocks to Buy <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore undervalued tech stocks with potential for growth in the market. </p>  9 Highest Dividend-Paying Stocks in the S&P 500 <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> While growth receives considerable attention, income potential is essential for many retirees and investors. </p>

9 Highest Dividend-Paying Stocks in the S&P 500 <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> While growth receives considerable attention, income potential is essential for many retirees and investors. </p>