Are Oportun personal loans really interesting? When it comes to securing a personal loan, Oportun stands out as a top choice for many reasons. One of the main advantages is the inclusive approach to lending. Unlike traditional lenders, Oportun does not solely rely on your credit score. This makes it an excellent option for individuals with limited or no credit history.

Additionally, the company’s commitment to transparency means you won’t encounter hidden fees or unexpected charges, giving you peace of mind throughout your loan period. Oportun also prides itself on providing a fast and efficient service. With a quick approval process, you can receive the funds you need in no time, ensuring that financial emergencies or opportunities are addressed promptly. Their personalized loan terms cater to your specific financial situation, making repayment manageable and stress-free.

OPORTUN PERSONAL

ZERO FRAUD LIABILITY Affordable paymentsMoreover, Oportun offers excellent customer service. Their representatives are available to guide you through the loan process and answer any questions you might have, ensuring a smooth and pleasant experience. By choosing Oportun personal loans, you’re opting for a lender that values your financial well-being and strives to provide a supportive, fair, and flexible lending solution. Apply today and take the first step towards achieving your financial goals with confidence.

Oportun personal loans offer several benefits that make them an attractive option for many.

- No Credit History Required: Oportun offers loans to individuals without a credit history, making it accessible for those who might have difficulty getting loans from traditional lenders. Affordable Payments: The loans come with affordable payment plans that are designed to fit the borrower’s budget, helping to ensure that repayments are manageable.

- Quick Approval: The application process is straightforward and quick, often with same-day approval, providing fast access to funds. Credit Building: Borrowers can build their credit history with on-time payments, which is beneficial for future financial opportunities.

- Flexible Terms: Oportun provides flexible loan terms, allowing borrowers to choose a repayment period that suits their financial situation. No Prepayment Penalties: Borrowers can pay off their loans early without any penalties, saving on interest.

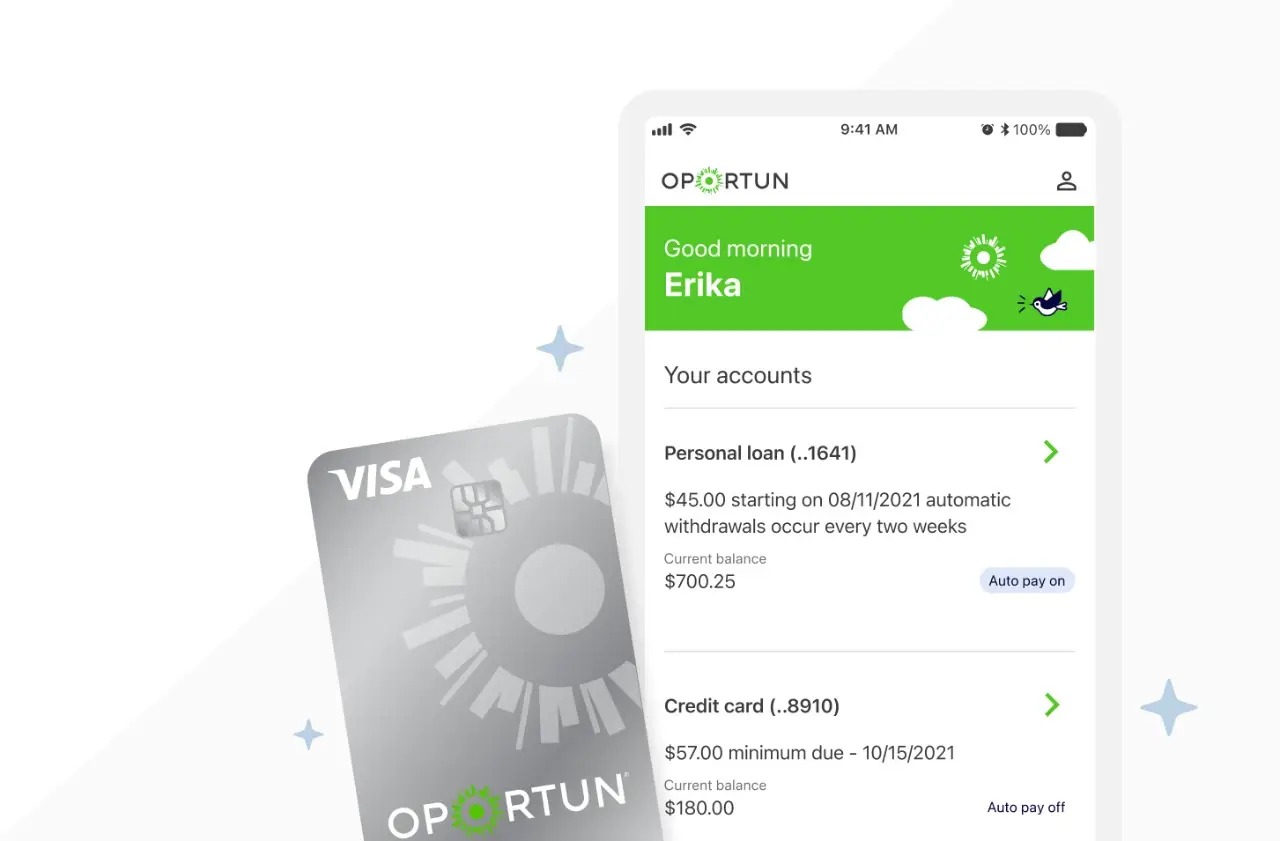

- Multiple Repayment Options: Oportun offers various repayment methods, including automatic payments, online payments, and payments at retail locations, providing convenience for borrowers. Personalized Customer Support: Oportun offers customer service in multiple languages and provides personalized support to help borrowers throughout the loan process.

Personal loans for better financial control

These benefits make Oportun personal loans a viable option for individuals looking for accessible, flexible, and supportive loan solutions. Oportun is a financial services company that provides personal loans, primarily targeting individuals who may have limited or no credit history. Here’s an overview of how Oportun personal loans work, their fees, and the requirements necessary for contracting one:

How Oportun Personal Loans Work

Loan Amounts:

Oportun offers loan amounts ranging from $300 to $10,000, depending on your state of residence and your ability to repay.

Disbursement:

Once approved, funds can be disbursed as quickly as the same day, either via direct deposit to your bank account or by picking up a check at a branch.

Repayment:

Loan terms typically range from 6 to 46 months. Repayments are made in fixed monthly installments. Oportun reports payments to the major credit bureaus, which can help you build your credit history.

Approval Criteria:

Oportun does not solely rely on credit scores for approval. They consider other factors such as income, employment history, and other financial information. Additionally, Oportun can perform a soft credit check, which does not affect your credit score.

Application Process:

You can apply for a loan online, over the phone, or at an Oportun branch. The application typically requires basic personal information, employment details, and income verification.

Fees and Costs

- Interest Rates: Interest rates vary based on the loan amount, term, and your credit profile. Rates can be relatively high compared to traditional bank loans but are competitive with other subprime lenders.

- Origination Fees: Oportun may charge an origination fee, which is a one-time fee deducted from the loan amount. The fee amount varies by state and loan size.

- Late Fees: Late payment fees may apply if you miss a payment. The specific fee amount will be detailed in your loan agreement.

- Prepayment Penalty: Oportun does not charge prepayment penalties, so you can pay off your loan early without incurring additional costs.

Requirements for Contracting

- Age: You must be at least 18 years old (19 in some states).

- Residency: You need to provide proof of a valid U.S. address. Some states may have additional requirements.

- Income: Proof of a steady source of income is required. This can be from employment, self-employment, or other verifiable sources.

- Identification: A valid form of identification, such as a driver’s license, state ID, or passport.

- Bank Account: A bank account may be required for direct deposit and automatic payments.

- References: As part of the application process, Oportun may request personal references.

Oportun aims to provide financial access and help individuals build a positive credit history through responsible lending practices. If you’re considering an Oportun loan, it’s crucial to fully understand the terms and conditions and ensure it aligns with your financial needs and repayment capacity.

Achieve Personal Loans <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Consolidate debts or make dreams come true with a personal loan through Achieve! </p>

Achieve Personal Loans <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Consolidate debts or make dreams come true with a personal loan through Achieve! </p>  Grace Loan Advance: Your Path to Financial Freedom <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Grace Loan Advance offers innovative loan options tailored to meet your financial needs, ensuring a swift and hassle-free borrowing experience. </p>

Grace Loan Advance: Your Path to Financial Freedom <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Grace Loan Advance offers innovative loan options tailored to meet your financial needs, ensuring a swift and hassle-free borrowing experience. </p>  Experience Financial Freedom with Upgrade Personal Loans <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> It's quick and easy to apply for a personal loan online – get started today and unlock your financial potential! </p>

Experience Financial Freedom with Upgrade Personal Loans <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> It's quick and easy to apply for a personal loan online – get started today and unlock your financial potential! </p>