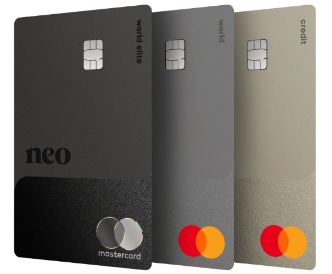

Finding a credit card that aligns with different financial goals shouldn’t be confusing. Neo Financial simplifies the decision with three distinct options: the Neo Mastercard, the Neo World Mastercard, and the Neo World Elite Mastercard. Each card is built with a clear focus—whether it’s offering a solid start for credit building, boosting rewards on everyday purchases, or delivering top-tier perks for high-income users. Neo Credit Cards

Designed for Canadians looking for flexibility, transparency, and value, these cards share a digital-first platform, strong cashback potential, and a seamless application process. Here’s what each one offers—and how to choose the best fit based on lifestyle, income, and spending habits.

Neo Credit Cards

Highest cashback offers Incredible benefitsKey Benefits of Neo Mastercard, World, and World Elite Cards

Each Neo credit card delivers real-world value—but the perks scale based on card level:

💳 Neo Mastercard

- Perfect for newcomers or low-maintenance users

- Up to 5% cashback at Neo partners

- 0% annual fee

- Base cashback on grocery and gas

🌍 Neo World Mastercard

- Higher everyday rewards than the standard card

- 2% cashback on recurring bills, groceries, and fuel

- Still no annual fee

- Additional cashback at thousands of local and national partners

🏆 Neo World Elite Mastercard

- Premium-level rewards across multiple categories

- Up to 5% at partners, plus:

- 5% groceries

- 4% recurring bills

- 3% fuel

- 1% other purchases

- Travel insurance, extended warranty, purchase protection

- $125 annual fee, offset by higher cashback potential

All three cards can be linked with the Neo app, providing real-time spending alerts, personalized partner offers, and credit tracking tools.

Understanding Fees, Interest Rates, and What to Expect

When it comes to fees, Neo is upfront—making it easier to compare and avoid surprises.

| Card | Annual Fee | Purchase APR | Foreign Transaction Fee | Partner Cashback |

|---|---|---|---|---|

| Neo Mastercard | $0 | 19.99% – 24.99% | 2.5% | Up to 5% |

| Neo World Mastercard | $0 | 19.99% – 24.99% | 2.5% | Up to 5% |

| Neo World Elite Mastercard | $125 | 19.99% – 24.99% | 2.5% | Up to 5% |

Important Notes:

- No overlimit or inactivity fees

- Late payment fees apply if missed (standard across most credit cards)

- Foreign purchases carry a modest 2.5% fee—standard for Canadian cards

Who’s Eligible and How to Apply – Requirements by Card

Neo makes applying simple—but each card has its own requirements based on income and credit score:

| Card | Recommended Credit Score | Minimum Income | Age Requirement |

|---|---|---|---|

| Neo Mastercard | 660+ | None | 18+ (province dependent) |

| Neo World Mastercard | 680+ | $50,000 (individual) or $80,000 (household) | 18+ |

| Neo World Elite Mastercard | 700+ | $80,000 (individual) or $150,000 (household) | 18+ |

How to Apply and What You’ll Need:

- Visit neofinancial.com/credit

- Choose your card based on your profile:

- Neo Mastercard: No minimum income, credit score recommended 660+

- Neo World Mastercard: $50,000 individual or $80,000 household income; credit score 680+

- Neo World Elite Mastercard: $80,000 individual or $150,000 household income; credit score 700+

- Fill out the secure online application—no paperwork required

- Get an instant decision in most cases

- Start using your virtual card right away if approved

The physical card arrives by mail within a few business days. No branch visits or extra documentation needed.

Neo Credit Card

Highest cashback offers Incredible benefitsFrequently Asked Questions (FAQs) – Neo Credit Cards

1 – Is there a soft check before applying?

Yes. Neo performs a soft credit check at the beginning, so applicants can explore eligibility without affecting their credit score.

2 – What makes Neo’s cashback better than regular rewards programs?

Unlike point systems, Neo delivers cashback directly—no conversions or redemption rules. Partner offers are personalized and can be used instantly.

3 – Are Neo cards accepted outside Canada?

Yes. All Neo credit cards are Mastercard, accepted globally both online and in-store. However, standard foreign transaction fees apply.

4 – What happens if the income requirement isn’t met?

Applicants who don’t meet the income threshold for World or World Elite may still qualify for the standard Neo Mastercard.

5 – Can the annual fee on the World Elite be waived?

At this time, the fee is fixed at $125 annually. However, cashback returns can easily offset this for high-spenders.

6 – Is the Neo app required to use the card?

No, but it’s highly recommended. The app enhances user experience with real-time insights, credit monitoring, and reward tracking.

Final Thoughts: Choosing the Right Neo Credit Cards

Neo Financial offers a well-structured lineup of credit cards, each tailored to different financial needs. The Neo Mastercard suits beginners or those wanting simplicity. For better rewards with no annual fee, the Neo World Mastercard is a strong choice. Meanwhile, the Neo World Elite Mastercard delivers premium perks for higher earners.

Overall, all three cards combine modern features, fast approval, and accessible rewards—making Neo a smart and straightforward option for Canadians.