Earn more on groceries, gas, dining, transportation, and everyday essentials with the CIBC Dividend® Visa Infinite Card—your gateway to premium rewards and elevated lifestyle perks

CIBC Dividend® Visa Infinite

cash back easy applicationThe CIBC Dividend® Visa Infinite Card is designed for consumers who want a premium cashback credit card that supports both everyday financial needs and lifestyle upgrades. It immediately captures attention with its elevated earn rates and strong category rewards, making it an ideal choice for families, professionals, and individuals with regular monthly expenses in essential areas like groceries, transportation, gas, and dining.

But the attraction goes beyond cash back. This card incorporates the prestige and convenience of Visa Infinite, providing access to personalized concierge assistance, curated dining programs, hotel perks, mobile device insurance, and comprehensive travel protections. This combination of financial value and premium service makes the card stand out in a crowded market.

The introduction sets the stage by emphasizing how the card blends meaningful savings with high-end perks. Consumers looking for a powerful, reliable, and flexible credit solution will appreciate how naturally this card fits into daily spending habits. It offers a compelling mix of earning potential, security features, and lifestyle enhancements—all wrapped into a well-rounded credit card experience.

Whether you’re managing a household budget or maximizing returns on everyday expenses, the CIBC Dividend® Visa Infinite Card provides benefits that can significantly improve the way you spend and save.

Benefits of the CIBC Dividend® Visa Infinite Card

High Cash Back on Everyday Purchases

The standout benefit of this card is its strong cash back structure, rewarding essential spending categories that form the core of most consumers’ monthly budgets. With elevated earn rates on groceries, dining, transportation, gas purchases, and recurring bill payments, users can accumulate meaningful cash back simply by using the card for routine purchases.

Unlike many reward programs that focus on niche categories, this card aligns with real-life spending patterns, making it easy for users to maximize cashback rewards without adjusting their lifestyle.

Access to Visa Infinite Premium Benefits

As a Visa Infinite cardholder, you gain entry to elevated experiences, including unique dining program invitations, preferential hotel benefits, concierge assistance, and premium travel perks. These features enhance travel planning, entertainment, and everyday conveniences.

For consumers who appreciate refined experiences, these benefits provide a layer of value that goes well beyond cashback rewards, offering access to high-quality services and exclusive opportunities.

Extensive Insurance Coverage & Purchase Protection

The CIBC Dividend® Visa Infinite Card includes multiple layers of insurance protection designed to safeguard your purchases, your travels, and your devices. Coverage includes mobile device insurance, purchase security, extended warranty, and various travel-related insurances.

These protections provide financial confidence, ensuring that cardholders can enjoy secure transactions and reduced stress, whether they’re shopping locally or exploring new destinations.

Product Strengths — How Consumers Benefit

The card delivers a strong combination of cash back earning power and luxury-level benefits. Consumers enjoy consistent savings on essential spending categories—areas where expenses accumulate quickly—while also benefiting from Visa Infinite perks that elevate travel and lifestyle experiences.

This combination creates a versatile financial tool that supports daily budgeting while adding meaningful long-term value.

Present the Savings and Potential Advantages

The elevated cash back rates help reduce everyday expenses, especially for families or individuals with active lifestyles. Over time, the accumulated cash back can help offset rising grocery costs, transportation spending, and dining budgets.

The strength of the rewards structure means savings grow effortlessly as long as the card is used consistently.

Present the Savings and Potential Advantages

The additional financial advantages come from premium travel insurance, mobile device coverage, and extended warranty protection. These features can significantly reduce unexpected costs associated with repairs, cancellations, or emergencies.

When combined with ongoing cashback earnings, these protections create substantial long-term savings.

Present the Potential Security

Security is a core advantage of the CIBC Dividend® Visa Infinite Card. With Visa’s advanced cybersecurity features, including Zero Liability protection, near-instant fraud alerts, and encrypted digital wallet compatibility, cardholders can shop with confidence.

These protections ensure that every purchase—online or in-store—remains safe and monitored.

Eligibility Criteria

Applicants must meet CIBC’s income thresholds for Visa Infinite products, demonstrate responsible financial behavior, and maintain a positive credit history. CIBC evaluates employment stability, payment history, and overall financial reliability before approval.

Application Process

- Go to CIBC’s official website and locate the CIBC Dividend® Visa Infinite Card page.

- Click “Apply Now” to open the secure online form.

- Enter your personal details, including identification, address, and contact information.

- Provide employment and income information to verify you meet Visa Infinite eligibility requirements.

- Review all card terms, including cash back rates, insurance coverage, and the annual fee.

- Consent to a credit check so CIBC can evaluate your financial history.

- Submit your application and wait for a fast approval decision.

- Once approved, activate your card through online or mobile banking.

- Begin earning enhanced cash back immediately, benefiting from premium purchase rewards and Visa Infinite perks.

Frequently Asked Questions

1. Does this card offer premium travel benefits?

Yes. As a Visa Infinite product, it includes exclusive travel, dining, and concierge advantages.

2. Are cash back rewards automatic?

Yes. Cash back accumulates as you make eligible purchases throughout the year.

3. Is it suitable for families?

Absolutely—its high cash back categories match common household expenses.

4. Does the card offer device protection?

Yes, mobile device insurance is included for added security.

RBC Avion® Visa Infinite Card — Travel Your Way with Premium Flexibility and Elite Rewards <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the freedom to book travel your way—no restrictions, no blackout dates, just pure flexibility. </p>

RBC Avion® Visa Infinite Card — Travel Your Way with Premium Flexibility and Elite Rewards <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the freedom to book travel your way—no restrictions, no blackout dates, just pure flexibility. </p>  Scotiabank® Scene+™ Visa Card — A Rewarding Everyday Card for Modern Lifestyles <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore how this no-annual-fee card transforms ordinary transactions into Scene+™ rewards that make life more enjoyable </p>

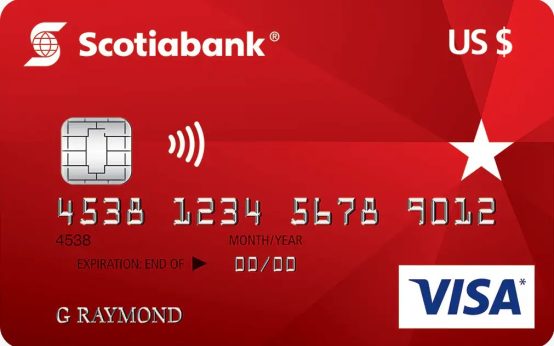

Scotiabank® Scene+™ Visa Card — A Rewarding Everyday Card for Modern Lifestyles <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore how this no-annual-fee card transforms ordinary transactions into Scene+™ rewards that make life more enjoyable </p>  Scotiabank® U.S. Dollar Visa Card — The Ideal Solution for Cross-Border and Online U.S. Spending <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how paying directly in U.S. dollars can simplify travel, online shopping, and international expenses. </p>

Scotiabank® U.S. Dollar Visa Card — The Ideal Solution for Cross-Border and Online U.S. Spending <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how paying directly in U.S. dollars can simplify travel, online shopping, and international expenses. </p>