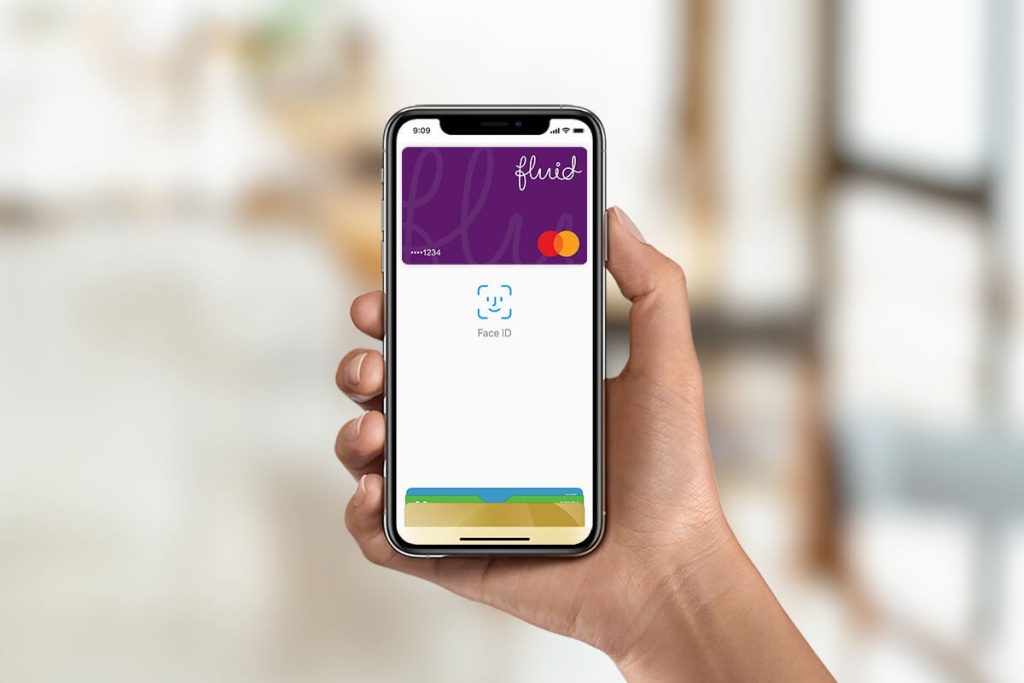

The Fluid Credit Card is a popular choice for individuals who want to improve or rebuild their credit profile through responsible, structured spending. Unlike many premium or reward-based cards that focus on travel perks or cashback, this card concentrates on helping users develop better financial habits. Before exploring its detailed features, two elements stand out immediately: its accessibility and its dedicated focus on credit improvement.

In the UK, many people find it challenging to be approved for traditional credit cards due to having a limited credit history, past financial difficulties or irregular income patterns. The Fluid Credit Card offers a solution by providing manageable credit limits, clear terms and straightforward repayment expectations. These features make it easier for users to avoid overspending while demonstrating consistent, responsible borrowing behaviour.

Another aspect worth emphasising is the card’s simplicity. With easy-to-use digital tools, regular payment reminders and built-in fraud protection, cardholders can manage their account with confidence. The Fluid Credit Card is not overloaded with complex features or reward structures; instead, it delivers stability and support. For people looking to rebuild their financial foundation slowly and sensibly, it offers an excellent starting point.

Fluid

FLEXIBLE CREDIT REQUIREMENTS easy applicationBenefits of the Fluid Credit Card

A Practical Path to Rebuilding Credit

One of the main advantages of the Fluid Credit Card is its clear focus on credit improvement. It allows users to establish a positive repayment history by making regular, manageable payments. This helps demonstrate to lenders that the cardholder is capable of handling credit responsibly.

For individuals aiming to increase their credit score, the card offers a structured and supportive environment that encourages good financial habits.

Straightforward Terms and Easy Application Process

The card is designed to be accessible, offering a simple online application and clear receipt of terms. Unlike more complex cards that require high income levels or excellent credit scores, the Fluid Credit Card provides an option for people who might otherwise struggle to obtain credit.

This straightforward approach ensures that users understand the commitments and expectations from the very beginning.

Full Digital Control Through Online Banking and Mobile App

Cardholders can manage their account entirely online, using the mobile app or website to track spending, schedule payments and adjust settings. This level of control is especially helpful for individuals aiming to rebuild their financial stability, as it helps prevent missed payments and supports better budgeting.

With real-time alerts and secure digital access, users can easily stay informed and in control.

Product Strengths — How Users Benefit

The Fluid Credit Card is particularly strong in areas related to support, accessibility and ease of use. Its manageable credit limits prevent users from getting into unmanageable debt, while its digital tools help reinforce responsible financial habits. The card is crafted for individuals who want a reliable starting point rather than complex benefits.

Additionally, security features including fraud monitoring and encrypted transactions provide added reassurance, making it suitable for online shopping and everyday spending.

Present the Savings and Potential Advantages

Improving a credit score can lead to significant savings over time. As cardholders build a strong repayment record, they may gain access to better financial products, lower interest rates and higher credit limits in the future.

The Fluid Credit Card helps users achieve this long-term financial improvement without overwhelming them with unnecessary features.

Present the Savings and Potential Advantages

The digital tools included with the card can help users avoid missed payments and late fees. By keeping track of due dates and spending limits, cardholders can maintain better control, reducing the risk of incurring avoidable charges.

This contributes to long-term financial stability and healthier credit behaviour.

Present the Potential Security

Security is a key component of the Fluid Credit Card. Cardholders benefit from fraud monitoring systems, transaction alerts and secure digital access, ensuring that every payment is protected. These features give users confidence whether shopping online, using contactless payments or making in-store purchases.

The card’s strong security infrastructure helps create a safe environment for rebuilding financial trust.

Application Process

- Visit the Fluid Credit Card website and select the option to apply online.

- Complete the eligibility checker, which performs a soft search without affecting your credit score.

- Review your eligibility result, which indicates your likelihood of approval.

- Proceed to the full application, providing personal details such as address history and contact information.

- Add employment and income information, allowing the lender to assess affordability.

- Review the card’s terms, including interest rate, credit limits and repayment conditions.

- Consent to a full credit check, required for final approval.

- Submit your application and wait for the confirmation decision.

- Activate the card upon arrival, following the instructions provided.

- Register for digital account access, enabling you to manage payments and track spending instantly.

Frequently Asked Questions

1. Is the Fluid Credit Card good for rebuilding credit?

Yes—its simple structure and manageable limits make it ideal for improving your credit profile.

2. Does it offer rewards or cashback?

No. The card focuses entirely on credit improvement and responsible spending.

3. What type of APR does it have?

It typically comes with a higher variable APR, encouraging users to pay off their balance monthly.

4. Can I increase my credit limit later?

Possibly. Responsible, long-term use may lead to a limit increase, depending on eligibility.

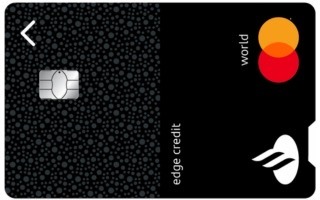

Santander Edge Card — A Smart, Practical Way to Save on Everyday Spending <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> A modern card offering meaningful rewards on essential purchases — helping you get more from your everyday spending. </p>

Santander Edge Card — A Smart, Practical Way to Save on Everyday Spending <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> A modern card offering meaningful rewards on essential purchases — helping you get more from your everyday spending. </p>  Santander Everyday Long Term Balance Transfer Credit Card — A Smarter Way to Reduce Debt Gradually and Confidently <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Take the pressure off your repayments and focus on long-term financial stability with extended balance transfer flexibility </p>

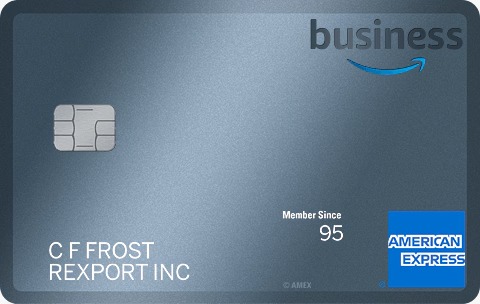

Santander Everyday Long Term Balance Transfer Credit Card — A Smarter Way to Reduce Debt Gradually and Confidently <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Take the pressure off your repayments and focus on long-term financial stability with extended balance transfer flexibility </p>  Amazon Business American Express® Card — Smarter Purchasing Power for UK Businesses <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how this business credit card helps UK companies streamline expenses, unlock Amazon rewards, and strengthen financial control. </p>

Amazon Business American Express® Card — Smarter Purchasing Power for UK Businesses <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how this business credit card helps UK companies streamline expenses, unlock Amazon rewards, and strengthen financial control. </p>